Refinance Your Home: Bigger Money Maker Than You Think?

A very common question that I get as a mortgage loan officer is “Why should I even consider refinancing my house at all?” That is a great question. There are several reasons why choosing to refinance would be a great option for you.

The main reasons why you would want to consider refinancing your home are: Lower the interest rate, drop off private mortgage insurance, refinance from an adjustable-rate mortgage (ARM) to a fixed rate, and cash out for debt consolidation or projects.

Refinance to Lower your Interest Rate

The first option we will look at lowering your interest rate. This is the most obvious and most common reason for lowering your interest rate.

Depending on when you bought your home will most likely determine what your interest rate is. There are a lot of factors that go into what sort of rate you can get but the first is what the rates are according to the Fed. If you bought your home in the 80s and haven’t refinanced at all since you can be looking at interest rates in the double digits. At the time of this writing, they are hovering around the 3% range, depending on the loan product.

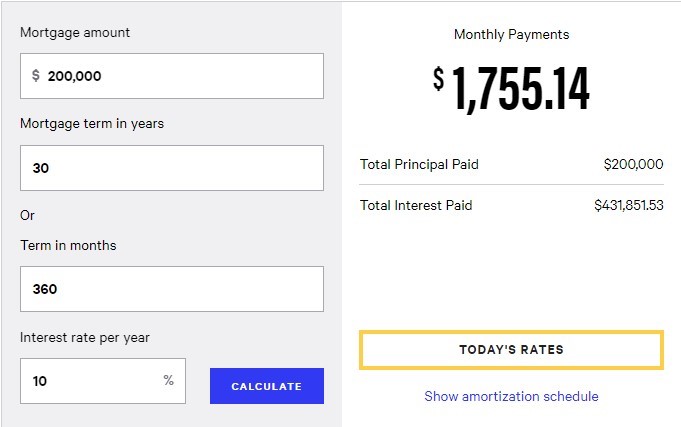

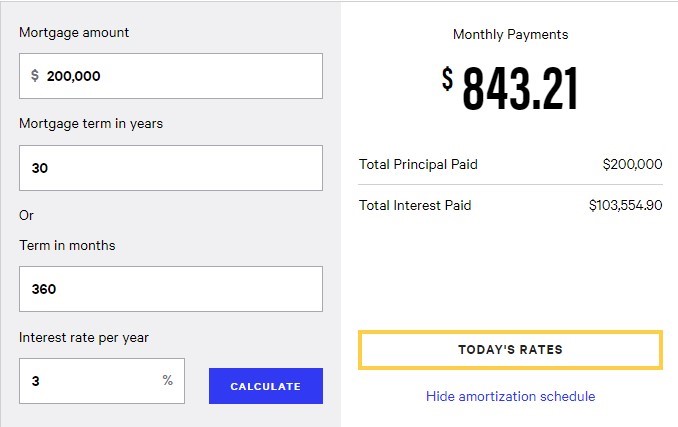

Looking at Figure 1 below, we can see the difference that changing the interest rate makes on the payment.

As you can see all of the factors are the same in terms of these loans except the interest rate. One is an interest rate of 10%, the other is a rate of 3%.

The 10% loan has a payment of $1,755.14 while the 3% loan has a payment of just $843.21. This is a difference of $911.93. That’s more than double the payment of the 3%.

Also, the amount of interest over the life of the loan is significantly higher as well with a total of $431,851.53 for the 10% loan compared to just $103,554.90 for the 3% loan even though the loan amount and term are EXACTLY THE SAME.

This example shows you how much of an impact the interest rate has on your mortgage payment. If the mortgage rates are at an attractive level, refinancing to lower your rate can save a lot of money in the long run.

Refinance to Get Rid of Private Mortgage Insurance

I get a lot of borrowers who currently have an FHA loan with mandatory private mortgage insurance (PMI) and they would like to get it removed. Depending on the loan product and when it originated, the PMI may never drop off which means that the only option you have to get rid of the PMI would be to refinance from the FHA loan into a conventional loan, provided you have an 80% LTV or less.

If you have more than that, or the closing costs associated with the loan would push you above that point, it still may be worth it to refinance. I’ll tell you why.

If you have an FHA loan, your PMI is probably at a rate of about 0.80-0.85% or more, depending on when you originated the loan. If you refinance into a conventional loan, depending on your credit score and type of property, your PMI could be anywhere from 0.10%-0.40%. See the difference?

Also, if you refinanced into a conventional loan at a great rate, even if you have to pay mortgage insurance, which will most likely be lower than the rate of PMI you’re paying on an FHA loan, it will eventually be eligible to be dropped off at the 80% LTV mark. With the FHA loan, your current LTV is not a factor, it all depends on what your LTV was when you originated the loan and how many years you have been paying on the loan.

Refinancing from an Adjustable-Rate Mortgage (ARM) to a Fixed Rate

There is a time and place for ARMs but I typically do not recommend them for your everyday borrower. ARMs can be beneficial in a market where the rates are dropping dramatically or for people who plan to refinance shortly after buying or plan on selling shortly after a refinance.

The idea here is that historically you have a pretty good idea where rates are going whether they’re moving up or down. If you’re an investor, and want to buy the property but plan to do a cash-out refinance 6-12 months after the purchase, or you’re planning on selling after a few months of rehab, an ARM can make sense since rates tend to be lower for an ARM. With ARMs the borrower is taking all the risk because as the market moves, so does the interest rate so the lender can make a consistent amount of interest compared to the market. With a fixed-rate loan, most of the risk is held by the lender because if you hold your loan for the entire duration of the term, in most cases 30 years, the interest rates could increase leaving the lender with less money than they would have otherwise.

There are mortgage products that are convertible, meaning that they can start as ARMs and convert later on into a fixed rate, but these are not common. Unless you have one of these aforementioned products the only way to get out of an ARM would be to refinance into a fixed rate. This can be a great idea if you suspect that the rates are going to start to increase and you want to lock your rate into a lower rate rather than ride the fluctuations of the market.

Cash-Out for Debt Consolidation, Projects, or Investments

Debt Consolidation

The last reason to refinance your current mortgage would be to do a cash-out to pull equity out of your property. The biggest reasons would be to pay off the existing debt that has a higher interest, to take that money to complete projects around the house, or to use it on other investments such as a rental property.

The first reason would be to pay off existing high-interest debt. Some people ask me “Why would I take out equity from my home to pay off debt?” Well, because in most cases it makes sense.

This is called debt consolidation. Consolidation is when we combine two things. In this case, we are combining 2 different types of debt. Depending on the type of debt and amount, this can be very beneficial. I’ve worked with borrowers that had high-interest debt and consolidated in this same way.

Let’s say that you have $20,000 in credit card debt. Interest rates on credit cards are notoriously high. They can be around 18% on the low end and 30%+ on the high end. On a $20,000 credit card bill at 18%, you could make an $800 monthly payment every month and it would still take you 16 years and 2 months to pay it off. This is because of the high-interest rate.

Now, on the other hand, if you refinanced and took our $20,000 to pay off that credit card, you would be consolidating your high-interest debt to a much lower interest. For a 30-yr, fixed-rate mortgage of $200,000 at 3%, the principal and interest payment would be around $843 a month. If we added an extra $20,000 to the loan to make the loan amount $220,000, all other factors the same, the new payment would be $928 a month.

That’s an $85 monthly increase, compared to the $800 monthly payment you would have on your credit card.

Not only would you be able to consolidate your debt into a much lower interest rate, but it also becomes much more manageable on your monthly payment.

One more thing to take into account with this scenario is that you’re borrowing against an appreciating asset. This means that your home will continue to increase in value over time making the $20,000 debt much more manageable because when you do decide to sell in the future you will most likely have even more equity than when you refinanced in the first place.

Projects

Another reason to do a cash-out refinance is for projects, typically projects that add to your home.

Many people love this option because not only can the cash you’re pulling out of your home pay for upgrades that you can enjoy daily like a beautiful bathroom, kitchen, or pool, but it can also add value to your home. In some cases, it can, quite literally, pay for itself.

Real Estate experts agree that some projects will always be worth doing like kitchens and bathrooms, they are what sell the house. Your home may be comparable to a lot of other homes on your street, but if everyone else has upgraded their homes recently and you haven’t you may find that you are not able to get nearly as much value for your home as you were hoping for.

Other Investments

This next one can be tricky and not intended for the faint of heart. Before I move on, I have to impress upon you that this is in no way financial advice, nor am I a certified financial advisor. One option that some people take in pulling equity out of their home in the form of a cash-out refinance is to apply towards other investments, most notably real estate.

Let’s say that you have a home that’s worth $200,000 and you currently owe $100,000. You bought at a good time, you’ve paid down the mortgage for a few years and the market has been good to you so it has appreciated. You have $100,000 in equity in your property right now. Now, let’s say you wanted to pull out $50,000. You could pull that $50,000 out and apply that towards a 25% down payment on a rental property down the street worth $200,000. Now, using the equity in your current property you have your current home with a mortgage of $150,000 (not including a few thousand for closing costs of the refinance) and a rental property with a mortgage of $150,000 that you can invest and start making rental income.

This is a very common tactic that real estate investors employ to grow their rental portfolios. Just be careful that you do over-leverage yourself and end up buying properties that are not good investments because real estate is not an investment with high liquidity or not very liquid. This means that it is not easy to sell and access your money like stocks or cryptocurrency.

We’ve gone over the most common reasons why you would want to do a refinance with your home. I hope you’ve learned a lot and feel like you are now well informed to make the best decision for your future. Thanks,