What is the Fastest Way to Reach Financial Independence?

The fastest way to reach financial independence is through Real Estate investing. There are two main reasons for this. The first is that there are multiple ways to make money from every investment and the second is that you can scale with real estate faster than any other investment.

Multiple ways to make money in Real Estate

There are multiple ways to make money with each investment. These are making money through appreciation, rental income, principal pay-down, and tax deductions.

Appreciation

The fastest way that a lot of real estate investors make money in real estate, especially in the single-family market, is through appreciation. Appreciation is the slow growth in real estate prices over time. Depending on where you live an average annual rate can be between 2-6%. In 2021, we saw some areas in the country hit appreciation rates upwards of 20% or more.

Let’s say you buy an investment property for $200,000.

Now, let’s say that the average annual rate is 5% for that area. The following is how we would calculate what the appreciation would look like after 7 years. Instead of multiplying the price of the property by 0.05, or 5%, and then adding to the original value, we are going to skip a step and multiply the original value by 1.05 instead.

Year 1 200,000 x 1.05 = $210,000

Year 2 210,000 x 1.05 = $220,500

Year 3 220,500 x 1.05 = $231,525

Year 4 231,525 x 1.05 = $243,101.25

Year 5 243,101.25 x 1.05 = $255,256.31

Year 6 255,256.31 x 1.05 = $268,019.13

Year 7 268,019.13 x 1.05 = $281,420.09

As you can see, at the end of year 7, your home value would be estimated around $281,420 just because of appreciation. That is a 40% increase in value of $81,240 compared to your purchase price of $200,000.

Rental Income

The next source of making money in real estate is rental income. This is the most obvious source of return to many. This is the money that your tenant pays you to live on the property.

Let’s say that your mortgage is $1,200 but the market rent for your property in that area is $1,500. This means that every month after you pay the mortgage, also known as debt service, you still have an extra $300 left over to pay for maintenance, capital expenditures, and savings. Capital expenditures are large repairs like replacing the roof or windows. For the first year, you would have made $3,600 in income after the debt service payment.

Another factor to keep in mind is that as long as the economy is growing, the rent will typically go up every year.

Let’s say that the rent goes up every year by $50 a month. We will also assume that the debt service payment stays the same, not accounting for increases in taxes or insurance, for this example.

Year 1 300 x 12 = $3,600

Year 2 350 x 12 = $4,200

Year 3 400 x 12 = $4,800

Year 4 450 x 12 = $5,400

Year 5 500 x 12 = $6,000

Year 6 550 x 12 = $6,600

Year 7 600 x 12 = $7,200

Total in 7 Years = $37,800

After 7 years of investing in this one property, you would have made $37,800 just in income after debt service payments.

Principal Paydown

The next area in that we can make money in real estate is by capital paydown.

We will assume that the property was leveraged with 75% financing after we put down $50,000 so that the mortgage principal starts at $150,000.

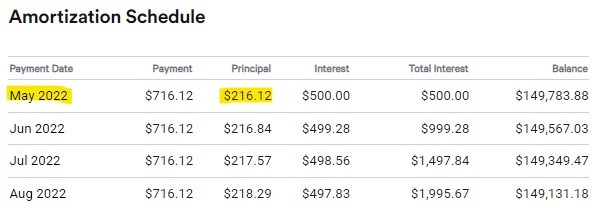

This is an amortization schedule for a 30-year mortgage, at 4%. As you can see, the first principal payment is $216.12. Every time another payment is made, more of the payment goes toward the principal paydown and less goes toward your interest.

When we go all the way down to May 2029, after 7 years of paydown, we can see that the monthly payment has grown to $285.83 a month. The current principal amount after 7 years is $128,803.38. That is $21,196.62 less than the start of $150,000. Your tenant has paid down your mortgage this much during this time which has increased the amount of equity you have in your property.

Tax Deductions

The last way we can make money through real estate is through tax deductions. Real estate is a very tax advantageous investment. You can write off a lot of things that are paid for during the investment. Some include the mortgage interest, the taxes, insurance, any maintenance that you have paid for, and also any landscaping, to name a few. Also, you can deduct all charges for property management as well, including monthly fees, tenant placement fees, and new lease fees.

The way taxes work with real estate investments is by taking the number of deductions and applying them toward your income, which then decreases your tax burden.

Let’s say that you are working with an accountant and you add up all of the deductions from mortgage payment items such as interest, taxes, and insurance. We will also look at the property management, landscaping, and maintenance and after one year you have $15,000 worth of deductions. Now we will use the previous example of income but instead of just looking at the money we made AFTER paying the mortgage we’re going to look at the money we made in total INCLUDING the mortgage. In one year that would be $18,000 = $1500 x 12.

If you have $15,000 worth of deductions that means that you would decrease your taxable income from $18,000 to $3,000. Now, your accountant will calculate what tax bracket you are in and apply that to your income. If you were paying 20% in taxes, you would only have to pay 20% of $3,000, not $18,000.

$3,000 x 0.20 = $600

$18,000 x 0.20 = $3,600

In this scenario, you saved $3,000 in just one year because of tax deductions, and this means more money in your pocket as profit.

Total Gains

Now we are going to look at the total gains through all of the money-making sources that we have discussed.

We made $81,240 from the appreciation of the property in 7 years

We made $37,800 from the income after paying the monthly debt service.

We made $21,196.62 from the principal paydown.

And lastly, we saved about $3,000 in tax deductions from just one year. As the income increases, the tax deductions will increase as well saving you more money, so let’s assume that the tax savings increase by $1,000 to keep things simple.

Year 1 $3,000

Year 2 $4,000

Year 3 $5,000

Year 4 $6,000

Year 5 $7,000

Year 6 $8,000

Year 7 $9,000

Total $42,000

After 7 years of holding the property, you would have a guesstimated amount of about $42,000 in tax savings because of deductions.

$81,240 + $37,800 + $21,196.62 + $42,000 = $182,236.62

Your total gains after 7 years from all sources would be $182,236.62! This is on a $50,000 investment to buy the property!

That’s an amount that is 3.6 times your investment.

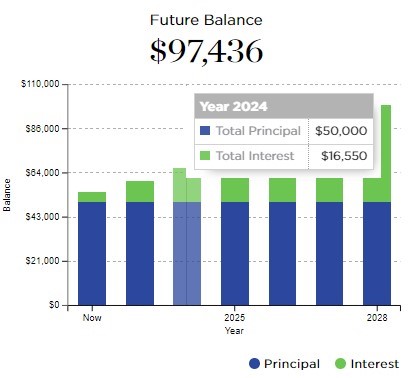

Thanks to NerdWallet.com, you can use a compounding interest calculator to compare the returns to the stock market.

If we took that $50,000 and put it in the stock market, with an average annual rate of 10% over the last 100 years, and with compounding interest over 7 years, it would yield a return of $97,436.

This is not a bad way to invest your money, because investing anything anywhere is better than not investing anything and letting it be eaten away by inflation. But you can see the difference between a real estate investment return of $182,236.62 and a stock market return of $97,436, making this one reason the quickest way to financial freedom is, in this author’s opinion, Real Estate.

Ability to Scale

The other reason that real estate is a better way to reach financial independence is through the ability to scale your portfolio faster.

Scaling is the ability to grow something fast. The reason real estate is easy to scale is that you can leverage your dollar due to financing. If I buy $50,000 worth of stock, I control $50,000 worth of stock.

If I put down $50,000 on a property worth $200,000, I control $200,000 worth of real estate, not just $50,000. When that property grows at 5% per year, it’s growing off of the original price of $200,000, not the $50,000 I put down.

Also, the rent is based on the market price of the property, not the amount that you put down. The market does not care whether you put down 25%, 10%, or even 0%, you still control 100% of the value of that property. If the market determines that the property is worth $200,000, that is how much you control.

Another strategy to scale is the ability to pull equity out of your property. If that property increases in value to $255,000 after 5 years, you could do a cash-out refinance and pull another $50,000 out of the property and use that as a down payment on another property. Now you have your first property working for you to get another after just 5 years. Now you have 2 income-producing properties, all stemming from that first investment of $50,000 in the first property.

In this case, you would not control one property at $200,000, and another at a value of $255,000, with a combined value of $455,000.

You would have to realize a return of over 4 times with your stock market portfolio compared to your real estate by gaining $55,000 and even then, you would still control less than a quarter of the value at only $105,000 compared to $455,000.

This is what makes real estate investing such a great strategy toward financial independence. Your portfolio can grow a lot faster than stock market methods. Not only will the return per investment be a lot higher, but you can scale into more investments faster as well. Thanks for playing!

Check out the other reason why Real Estate is the fastest way to financial independence!