What Is Included in My Mortgage Payment?

Most borrowers know what their mortgage payment is. They also know when it is due. What most don’t know is actually what is comprised of the mortgage payment. What exactly is in my mortgage payment?

The initialism that you will commonly hear is PITI. PITI stands for Principal, Interest, Taxes, and Insurance.

Principal

The principal is the amount that you have borrowed and have yet to pay off. If you borrowed $200,000 and you’ve paid down $50,000, you still have $150,000 of principal left over. This is the amount that interest is based on. If you stop paying your payments, or you have negotiated some sort of deferment with your current loan servicer, this amount will not increase, but your interest will.

Interest

Interest is the next component of a mortgage payment. Your interest is calculated using the amount of principal you have left on your loan and your current interest rate.

Let’s say you have a principal balance of $200,000 and a fixed interest rate of 3%, you would multiply your principal amount by the rate.

200,000 x 3% = 200,000 x 0.03

200,000 x 0.03 = 6000

The amount you get is $6,000. We are still not done. That is an interest amount expressed as an annual cost. To find our monthly payment we then have to divide 6,000 by 12.

6,000 / 12 = 500

Now we come up with 500. The monthly interest charged on a $200,000 loan at a 3% interest rate is $500 a month.

Since mortgages are amortized, that means that the payment stays the same, in terms of a fixed-rate loan, but the amount of the principal and interest fluctuates. Since the principal balance is slowly going down that means that with every payment you make there is a slightly higher amount of principal being chipped away while the interest amount slowly goes down. This is important when you’re considering a refinance because although you may be decreasing your interest rate, you want to take into account that when you start a loan you reset the interest schedule. There’s more interest taken out relevant to the payment earlier on in the life of the loan.

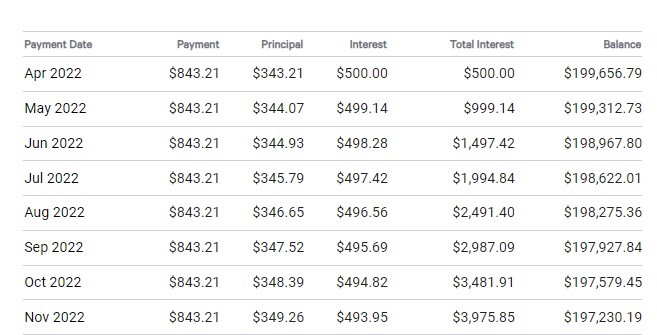

Below in Figure 1, you can see how the paydown of principal is affected by the amount of interest that you pay monthly.

Figure 1

You can see that after making your first month’s payment the number of principal drops by $343.21 since this was the amount of principal paid down, and the interest drops by $0.86. This might not seem like a lot but over a 30-yr period, it starts to add up. This is why some people prefer to do bi-weekly payments.

Biweekly payments are difficult to set up, depending on your servicer, because they do not want you to do it. You make a payment every 2 weeks instead of once a month, but your payments are cut in half. This allows you to stay within your budget for the month while making 2 payments.

This does 2 things:

First, it allows the interest to be paid off faster. Why? Because when you pay 2 payments instead of one, you are chipping away at the principal more frequently so the interest does not have as much time to accrue for the month.

Second, when you make payments every 2 weeks, you’re making the 13th payment at the end of the year, in essence. Why is that? Well, it’s because if you make payments every 2 weeks at half of a month’s payment, you end up making 26 payments. If you just made payments twice a month instead of every 2 weeks you would only make 24 payments. Making payments every 2 weeks accounts for a 13th month’s payment whereas, with monthly payments, you would only make 12 payments. This is an entire payment that you would not be made with monthly payments which chip away at the principal faster, while also decreasing the amount of interest at a faster rate. You can see why the lenders don’t like this strategy, it means less money for them. But you should keep your money, they make enough.

The only caveat to this is that you have to pay ahead of time instead of behind. What do I mean by this? Right now, if you’re making your payment, you have a due date that is every month, typically on the 1st. You have a 15-day grace period, which most lenders won’t tell you about, which says as long as you make a payment by the 15th of the month, they will not charge you a late fee. You can make a payment after it’s due, up until the 15th.

With biweekly payments, the bank wants you to make extra payments upfront. I’m not sure why they do this, most likely because of risk, but it means more money out of your pocket sooner than later. This is the only downside to this program because you’re tying up more money early on. If you are comfortable doing this, then it can save you a lot of money in interest, and pay your loan off faster, in the long run.

Taxes

The next component of a mortgage payment is Property Taxes.

The property taxes are calculated by the governing municipality in your area, most likely your county. They calculate your taxes according to the appraised value of your home according to their records. This is not always the same as the appraised market value for selling your property. If you want a breakdown of their calculations you can go to the county website and search for your property. There will be a detailed account of all of the owners throughout most of, if not all, of the history, depending on how old the property is. They will have a figure that represents their appraised value as well as any exemptions.

An exemption is a reduction toward your tax burden of the asset. Depending on where you live, there is a standard tax exemption for real estate that is typical $25,000 and if your home is a homestead then you will qualify for the Homestead Exemption, which is $25,000 as well. So, right away you can have a $50,000 exemption on the taxes for your property.

The county takes this appraised value and applies the exemptions to come up with the taxable value of your property. Then they apply their calculation based on how much they tax. They will calculate their budget and apply what is called a millage rate to the calculation. They will take the taxable value of your property and multiply it by the millage rate and this is how they come up with the annual tax. They will then divide that by 12 to come up with the monthly payment.

Keep in mind that the amount that is collected by your mortgage servicer is an estimate since taxes can increase. There will be times when they underestimate and this could lead to a shortage in your escrow account. By law, your mortgage servicer is allowed to collect up to 2 months of your escrow account extra as a buffer, but no more. This is to allow for unforeseen fluctuations. If your account is more than 2 months’ buffer at the end of the year, you may get an escrow refund check in the mail.

Insurance

The insurance section of the mortgage payment can be 2 different parts. One part, which will always be a part of your escrows if your mortgage loan requires escrows, is the homeowner’s insurance. The other would only apply to certain loan products and Loan-to-value minimums, that is private mortgage insurance.

Your homeowner’s insurance is the insurance that you pay for that covers your home in the event of loss or damage. If anything happens to your homes such as a water pipe break, hurricane, or fire, this is what will cover your home’s damage, assuming of course that the insurance does in fact cover losses in that event. Homeowner’s insurance is incredibly important because for most people their home is their biggest investment and you would not want your home to be subject to damage or the elements without some sort of coverage.

Depending on the loan product you have, homeowner’s insurance is required. Your mortgage loan officer will be able to explain what category you fall into.

The other type of insurance that may apply to your particular situation would be private mortgage insurance (PMI), otherwise known as mortgage insurance.

The most important thing that I want you to understand is that mortgage insurance DOES NOT cover your home, NOR does it cover any of your belongings OR anything else that you own for that matter. Mortgage insurance only covers the LENDER should you default on your loan. This is why all conventional loans require mortgage insurance down to 80% LTV. Once you get to 80% LTV, your conventional loan is eligible to have the PMI dropped off completely from your loan payments. Other loan products have different requirements in place for mortgage insurance or none at all.

Private mortgage insurance only covers the lender against default by the borrower. If you stop paying your mortgage payments, you would then default on your loan which can then lead to a foreclosure. If you borrow money from a lender and then foreclose, that means the lender now has a property it does not want and is not getting paid the interest it was hoping for according to the contract that you signed. Private mortgage insurance is a way for the lender to recoup at least some of the losses it incurred by you defaulting on your loan.

The reason that the magic number is 80% LTV is because studies show that mortgage defaults typically drop statistically around the 20% equity area. This is explained by the hypothesis that once people gain at least 20% equity in their homes, the desire to default drops dramatically. It seems that is a sufficient amount of equity to fight for the investment.

Depending on the mortgage loan product that you have will determine whether or not private mortgage insurance is required or whether or not escrows are required at all. For example, if you have a conventional loan with less than 80% LTV, you are not required to have escrows. Some people would prefer to pay their homeowner’s insurance and property taxes on their own. In this case, your mortgage payment would only consist of principal and interest on the amount borrowed.

I hope this clears up what components make up a mortgage payment and give you a better understanding of the requirements as well, leaving you well informed to make the best decision for you and your family.

Thanks,